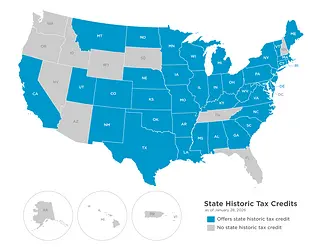

State Historic Tax Credits

For more than 30 years, the National Trust has supported the enactment and improvements of state historic tax credits. Today, the organization continues to work with partners to increase this number from the 38 states that currently offer this rehabilitation incentive. These credits attract private investment to reuse historic properties, many of which would otherwise likely be demolished. And true to their legacy as “laboratories of democracy,” states are innovating with different provisions to tackle complex issues such as rural economic development and affordable housing.

The National Trust has observed the renewed prosperity of countless historic communities throughout the country and in nearly every instance a common thread is the use of historic tax credits.

States marked in blue offered a historic tax credit as of January 2026.

State Historic Tax Credit Resource Guide and Data Center

With more than 70 percent of states adopting some form of historic tax credit incentive to support building reuse, the utility and success of this preservation policy is clear. As states look to strengthen and tailor these incentives, this State Historic Tax Credit Resource Guide offers an overview of the tangible benefits of historic tax credit programs, the elements of top-performing credits, and a state-by-state comparative analysis of key features. For more information, download the State Historic Tax Credit Resource Guide (PDF) and watch "State Historic Tax Credit Incentives: Tools and Perspectives for Building Stronger and Vibrant Communities.

The State Historic Tax Credit Data Center tool is intended to serve historic preservation policy makers, advocates, and practitioners alike as they determine the optimal incentive for their state. The tool allows them to compare up to three state programs at one time as well as a way to compare specific features of a state historic tax credit against all other programs. For more information, see the State Historic Tax Credit Data Center.

State Historic Tax Credits: Opportunities for Affordable Housing and Sustainability

Building on the updated State Historic Tax Credit Resource Guide and the companion State Historic Tax Credits Nationwide Data Center, this report provides new policy strategies and recommendations for how state historic tax credits can become an even more powerful tool to create new affordable housing, support sustainable development, and reduce carbon emissions. For example, since taking effect in 2019, the Illinois Historic Preservation Tax Credit Program (IL-HTC) has created thousands of jobs, prevented unnecessary building material waste, encouraged millions of private investment in historic places and brought needed affordable housing to market places. According to Quinn Adamowski at Landmarks Illinois, 99% of the housing units developed using the IL-HTC are affordable. Because the program makes both economic and environmental sense, it was extended for another five years and increased from $15 million to $25 million. For more information, download the PDF State Historic Tax Credits: Opportunities for Affordable Housing and Sustainability " and watch "State Historic Tax Credits: Opportunities for Affordable Housing and Sustainability."

Webinar: Advocating Successfully for State Historic Tax Credits

As thirty-eight states convene their respective legislative sessions in January 2026, Preservation Leadership Forum brought together three experts in state historic tax credits (HTCs) to share how New York, Kansas, and Maine each greatly improved their programs in 2025. Successes ranged from encouraging legislators to expand HTC percentages in rural areas to lifting the census tract restriction if a historic rehabilitation creates affordable housing.

Learn more and ask your own questions about the latest innovations in preservation incentives and how to advocate for state historic tax credits.

Resources

- State Historic Tax Credit Resource Guide (PDF, 2023)

- State Historic Tax Credit Data Center (External)

- State Historic Tax Credits: Opportunities for Affordable Housing and Sustainability (PDF, 2023)

- The Performance of Affordable Housing Provisions in State Historic Tax Credit (PDF, 2021)

- Report on State Historic Tax Credits: Maximizing Preservation, Community Revitalization, and Economic Impact (PDF, Executive Summary, 2018)

- Report on State Historic Tax Credits: Maximizing Preservation, Community Revitalization, and Economic Impact (PDF, Full Report, 2018)

The National Trust for Historic Preservation gratefully acknowledges the generous support of David and Julia Uihlein who made the development of the Resource Guide and interactive mapping tool possible.

Stay connected with us via email. Sign up today.

The National Capital Planning Commission is accepting public input until Wed., March 4 on the White House East Wing Modernization Project, including the proposed construction of a ballroom addition. Visit our page for resources to inform your comments and guidance on how to comment.

Learn More